Date: February 2021 | Author: John Gelmini

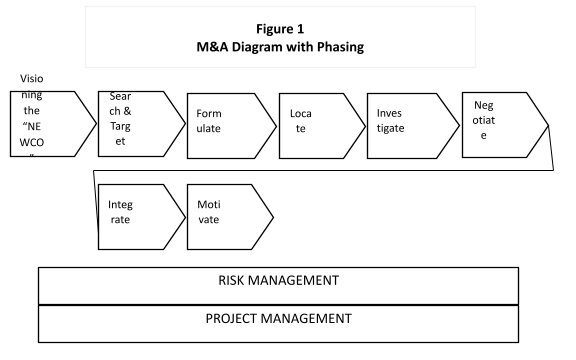

Until recently one could conduct an M&A and the subsequent integration of the 2 or more entities forming the “NEWCO” using a phased due diligence approach. This typically had 6 main components preceded by a Visioning & Search & Target process to determine the optimum shape and size of the newly merged entity.

Within each phase there are around 26 components of non-financial due diligence which are concerned with the present and the future in terms of things like people, process, resilience, adaptability, IT, operational tempo, marketing, brand integrity, reputational, risk, PRA, machine learning and BPO, and communication.

Historical data in the form of financial and legal due diligence is always majored on to arrive at a valuation favourable to the acquirer. In addition, jurisdiction in terms of tax efficiency, lower wage costs and minimisation of Corporation Tax over time is a consideration for larger acquisitions with an international component.

Coronavirus and related measures on “climate change”, “sustainability” and digital currency introduction represent potential risks that remain hazards until they happen.

Planning for successful M&As must now incorporate both prudent risk management to deal with known and quantifiable risks but also future-proofing.

Future-proofing is essentially educated guesswork about hazards and emerging trends which have the potential to become risks either short, medium or long term. Usually they are ignored by complacent managers and are uninsurable as they cannot be quantified by actuaries. Thus, Warranties and Representations insurance won’t cover them and even if it does the likelihood of a successful claim against the firm making the “representation” is next to zero.

Business Models of both the acquirer and the acquired therefore have to be future-proofed to ensure that the “NEWCO” can not only survive but prosper in the new environment.

There are several ways to futureproof:

- Backstepping

- Horizon Scanning

- Scenario Modelling

- Delphi

- Genius Ghosting/Wisdom Warfare combined with OODA LOOP

- Casual Layered Analysis

Which ones to use will depend on appropriateness, available time and budget.

Whilst looking internally at likely business performance one must look very closely at the 2 boards of directors and the next level down! Here one is determining which directors and senior managers are capable of “going the distance” into the bright future you envisage for the “NEWCO” or merged entity. One of the ways to do this is to reverse engineer the CV/Resumes of each director or senior manager. This is to ascertain whether their past successes and positioning were down to:

- Nepotism

- Cronyism

- Propitious timing

- Luck

- Hard work and effort

- Genuine ability plus “headroom” for improvement

You then want to see which of these directors and managers is capable of replicating those successes into the future and for how long.

Using the 80/20 rule and assuming an 8-person board, we know that:

- 2 will have enough “bench strength” and be fit for the future

- 2 will not be fit for purpose

- 4 will be average performers who with suitable mentoring, training and guidance will be suitable for a time but may need replacement later.

Figure 2

In this sense, the exercise is like the annual Grand National Horserace at Aintree in the UK in which some horses are deemed unfit to race, others are not entered, some fall over the jumps, fail to finish and have to be humanely dispatched. Leaving only the “future fit” get to win in that race and future ones.

There may of course be borderline cases where there is a replace versus “fix and repair” decision to be made about directors in the company about to be acquired. However, the ones identified as not fit for purpose at inception should be removed. The full cost of their removal and replacement needs to be deducted from the purchase price for that business. One should not, as happens all too often overpay and then have the costs of removing/replacing these people later. This is apart from the damage they will cause whilst remaining in position.

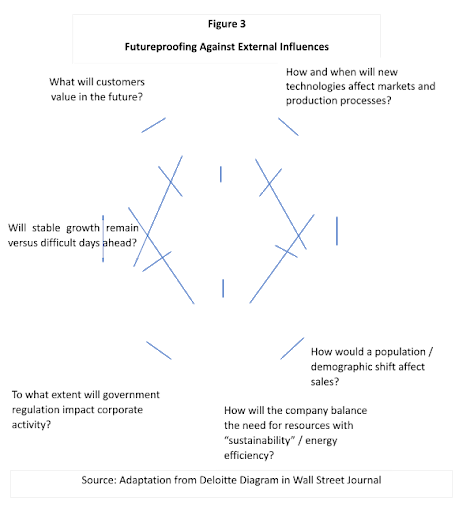

External factors and threats that will/may affect business performance

No business is an unassailable island and future-proofing means creating a “NEWCO” capable of withstanding future shocks and influences.

- Business Performance

- Materialistic versus Quality of Life

- Economic Momentum versus Volatility

- Technology Shifts versus Game Changers

- Resources versus Environment

- Markets versus Government

- More versus Less Immigration

These questions and others relating to outsourcing, offshoring, the supply chain and speed/adaptability of operation all need to be considered as part of the future-proofing process.

Current M&A methods fail to consider them with sufficient rigour which is why 80% of these transactions fail (Source: Professor Aswath Damodaran – Stern School of Business – New York.

Future-proofing means going beyond pure risk management to strengthen the “NEWCO” resulting from the M&A to the point where it can survive, prosper and absorb shocks in a world we don’t yet know.