True Continuity in business is not just about being prepared for major disruptions, so that essential business functions resume as normal…..it is a great deal more.

It is not just about reducing downtown, negating cyber threats, speeding recovery and safeguarding contingency plans…It goes far deeper.

True Continuity is, in our humble opinion, about building and nurturing a company that lasts between 250 and 500 years.

The 1660 Cobb Cottage we recently purchased is 364 years old. Livestock and villagers probably shared our living room when the Monarchy was restored under Charles II after a turbulent Cromwellian period, referred to as the English Revolution.

This building which is also my home office has been preserved and passed through generations.

Why do we rarely preserve companies and pass them through generations in the same way?

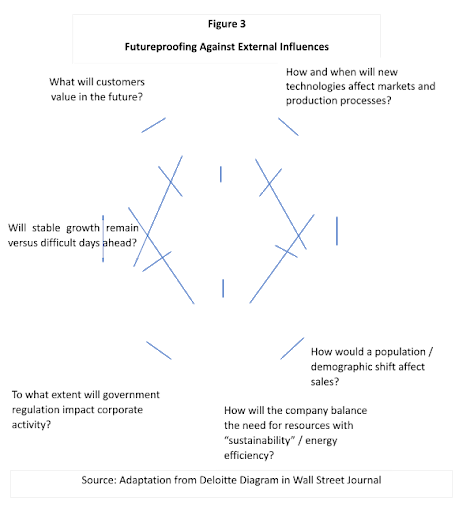

In an uncertain World with evermore frequent “black swan” events, company longevity is increasingly under threat.

Simon Sinek in his book “The Infinite Game” refers to a McKinsey study highlighting that the average lifespan of a S&P 500 Company has dropped by over 40 years since the 1960’s, from an average of 61 years to less than 18 years today.

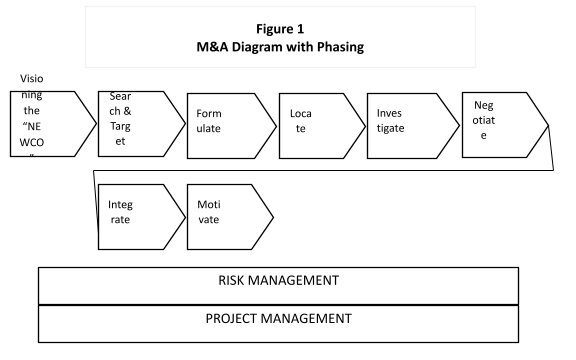

Robust small medium businesses are also severely disrupted by M&A activity after having survived precariously to secure investment.

This is why we all need our teams to find right fit investors with the same goals and united long term vision.

Agility and resilience are at a premium. Our teams need to be closeknit with a strong sense of purpose, have an inspiring, vibrant attitude, dedication, aptitude and will power.

Long lasting organisations need to be or become truly international, lean, diverse with multiple revenue streams to withstand Covid-style shocks….and our team culture needs to be full proof and highly supportive to prevail.

We at Truedil TM and Transaction Focus subscribe to the organic growth model and believe that Venture Capital and Private Equity investments do not always go hand in hand with what we view as True Continuity.

We want to enable and set up companies to last for future generations. This is what True Continuity really is about.

Organic Sales Growth Revenue is a good starting point.

Written by Charles Smee

https://www.truecontinuity.co.uk

https://www.transactionfocus.com